News

1. Europäische Chemikalien 2019 - J.P.Morgen

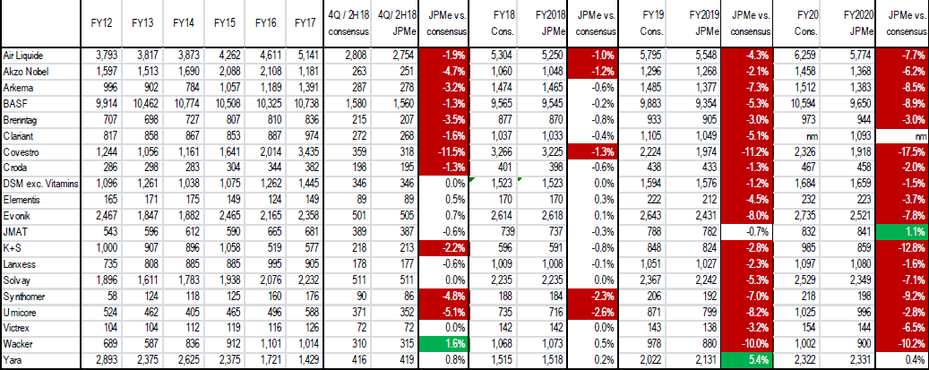

2019 earnings outlook challenging with J.P. Morgan 2019E EBITDA on average 4.4% below consensus…

- Due to slowing demand across multiple end markets combined with the likely moderation in chemical prices/spreads, we estimate the median EBITDA growth for the covered European chemical

companies of 3.8% in ’19 (including FX tailwind) vs. 5.7% in ’18. We expect a wide variation in growth but with downside to consensus for almost all these stocks with 4.4% average EBITDA downside

for the sector vs. consensus;

- 1Q will also be impacted by customer destocking due to the recent significant decline in oil price which combined with strong 1Q18 comp means that 1Q19 will likely be the toughest quarter with

gradual likely improvement through the year.

.. though reflected in recent significant correction with some cyclical stocks having corrected as much or more than in past corrections

- EU chemical sector has seen correction of ~21% from the peak over 2018 vs. average correction of ~35% in past major corrections, including those during the recessions except the 2008/09

recession caused by the Global Financial Crisis (GFC) which resulted in far worse correction in stocks;

- However, the relative underperformance of cyclical vs. more defensive names has been more extreme than in prior corrections. In fact, a few stocks including Brenntag, BASF, Lanxess, K+S,

Umicore and Synthomer have corrected from '18 peak by as much as or even more than in past major corrections;

- Further, in past major sector corrections, stocks usually bottomed in one to three quarters post the peak with the longest correction phase being during the ’08/’09 financial crisis lasting

five quarters. Thus, given EU Chem stocks peaked in early 2018, post the recent corrections the bottom should be close or already reached;

- Thus, some rebound in cyclical chemical stocks is likely if end demand stabilizes. Indeed, JPM base-case is slower but still above-trend global GDP growth in '19.

Sector valuation now below 5- and 10-year median

- The simple average 12m fwd EV/EBITDA of stocks in our coverage is now 8.05x vs. 5-year median of 9.34x and 10-year median of 8.6x

Key picks and avoids

- Key longs: BASF and Lanxess (upgraded from N), Brenntag, Yara, Elementis and Covestro

- Key avoids: Akzo (reinstate on UW); Air Liquide, Clariant, Wacker (all downgraded to UW); Synthomer and K+S

- We also upgrade Evonik to N from UW and downgrade Umicore to Neutral

M&A screen

- Balance sheet of companies, in general, is strong with ‘18E end ND/EBITDA of just over 1x. This combined with recent substantial derating in stocks might stimulate M&A in the sector

again.

- We see DSM, Synthomer and Lanxess more likely to do bigger size acquisitions, while Akzo, Arkema, Brenntag, Covestro, Croda likely to do bolt-on deals

Source: European Chemicals - Europe Equity Research 10 January 2019 by J.P. Morgan Cazenove

JPMe EBITDA vs. consensus

Source: J.P. Morgan estimates, Vara consensus, Bloomberg, company data

2. Geschäftsklimaindex – Chinesische Unternehmen in Deutschland 2018

Source: chinese Chamber of Commerce in Germany (CHKD)

3. M&A Aktivitäten Chinesischer Unternehmen in Deutschland 2017

Source: www.dealogic.com

4. M&A Deals Liste chinesischer Unternehmen 2017

Source: www.dealogic.com

Address: Fuchsgrube 36 | 45478 Mülheim | Germany

Tel: +49 (0) 208 30770920

Fax: +49 (0) 20846711469